Manage payroll and access health benefits and HR support for your clients right from QuickBooks Online Payroll.

QuickBooks Online Payroll Description

QuickBooks Online Payroll

Accountant-inspired and better than ever

QuickBooks Online Payroll is automated and reliable, giving you more control and flexibility. Not only will your clients know that their payroll is done right, you’ll also have more time to focus on advising them and growing your business.

Full-service setup

With Premium and Elite, experts will review your payroll setup so you’ll know it’s done right. With Elite you can also have an expert do it for you.

Integrated ecosystem

Access accounting, payroll and time tracking by QuickBooks Time**, all within QuickBooks for seamless business management.

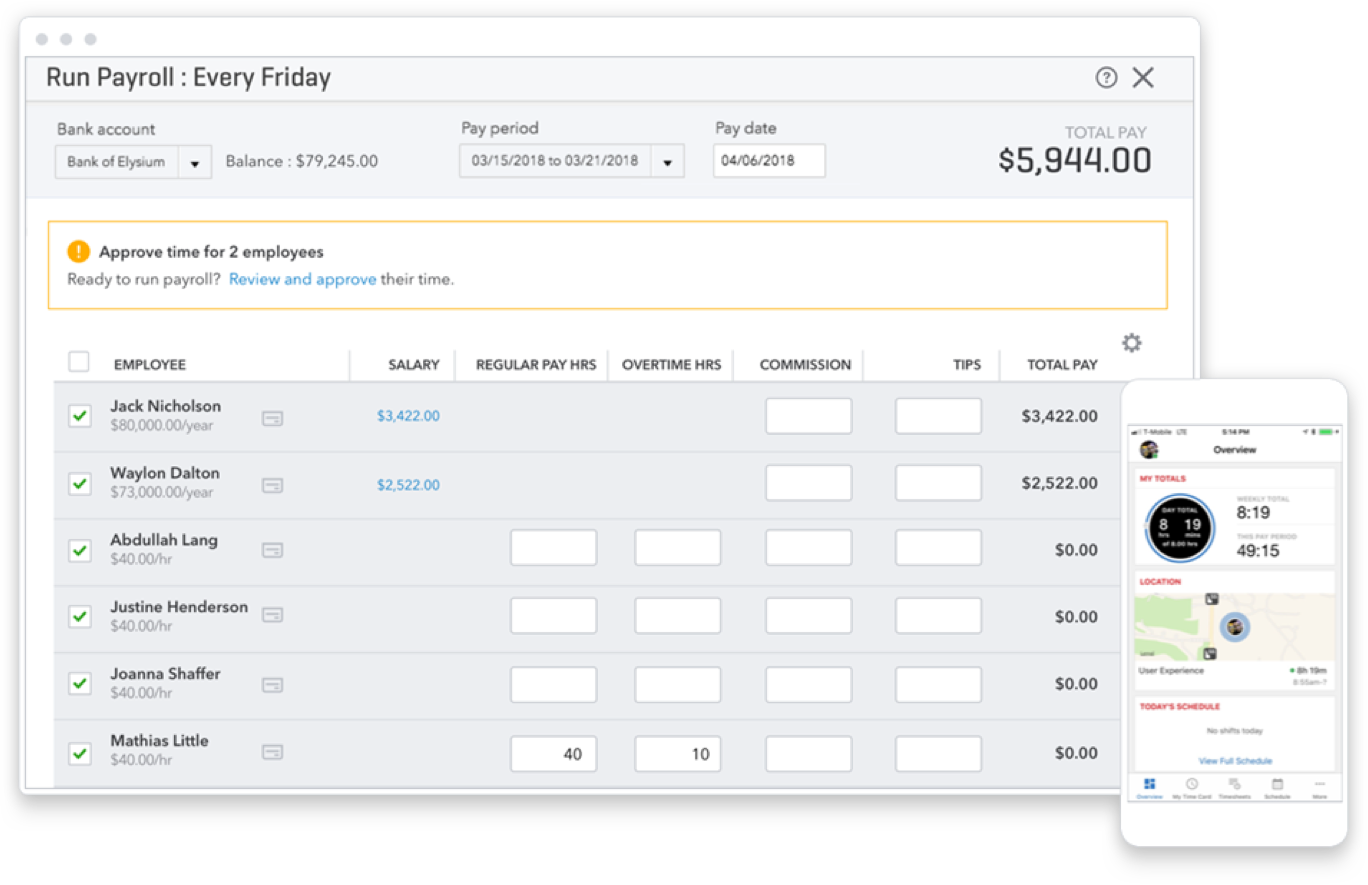

Run Payroll

After initial setup, payroll will run automatically**. Keep control of payments with clear alerts and notifications.

Single platform

Everything works right within QuickBooks

Easily manage your client’s books by integrating accounting and payroll in one place.

- Use the integrated collection of QuickBooks products, whenever you need them

- Access a full suite of HR and employee services**, including health benefits** and workers comp, managed right from your payroll account

- Automated time tracking by QuickBooks Time** is seamlessly integrated with QuickBooks Online Payroll so you can approve payroll anytime

Expert support

A wealth of expert knowledge at your disposal

Our experts are here to help, whether you’re growing your firm, sharpening your skills, or managing your work schedule.

- Our experts will review your payroll setup, or do it for you**, so you’ll know it’s done right

- Our payroll experts have deep product knowledge and are available to help when you have questions**

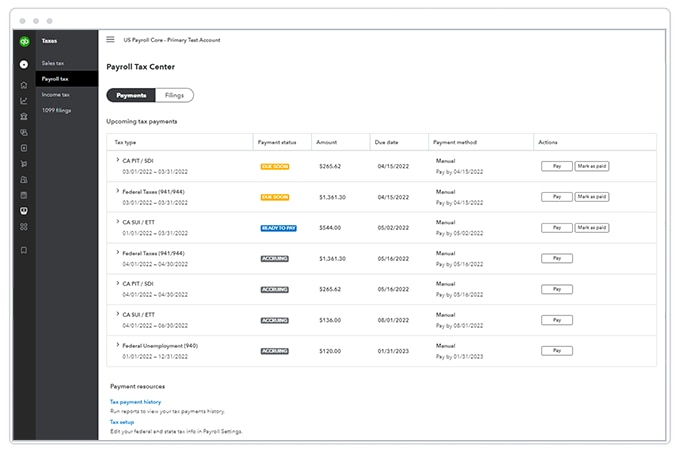

- With our Tax Penalty Protection in Elite, we’ll resolve filing errors and pay penalties – regardless of who caused the error**

Paychecks

Know which way the cash flows

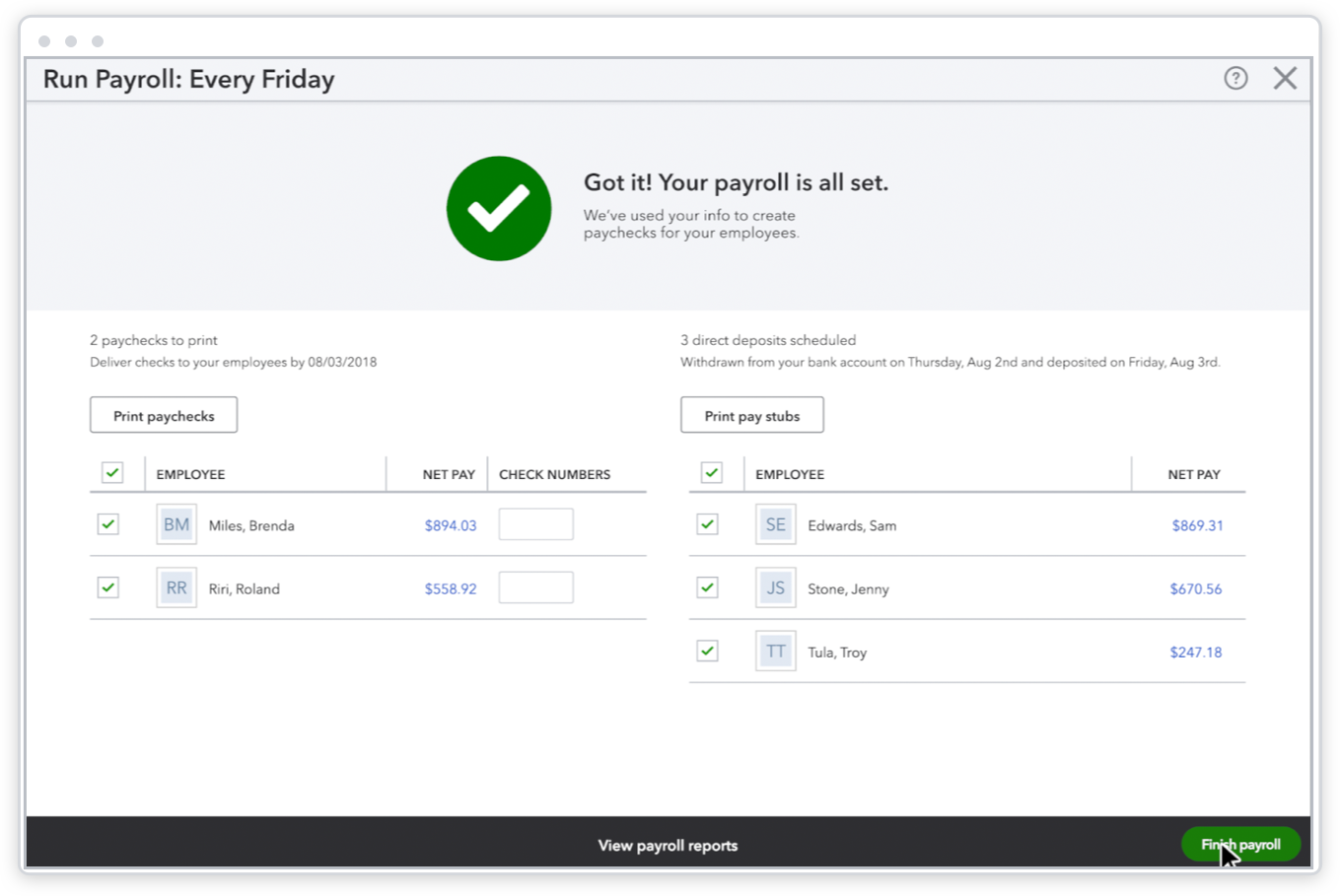

Set yourself up for success–eliminate tax penalties, choose how you pay your employees, and set up your own payroll system.

- Federal and state payroll taxes are calculated, filed, and paid, automatically**

- After initial set up, payroll will run automatically. Auto Payroll makes it easy to stay in control with clear alerts and notifications**

- Seamlessly pay W2’s and 1099 contractors on one platform. Employees can also view paychecks online**